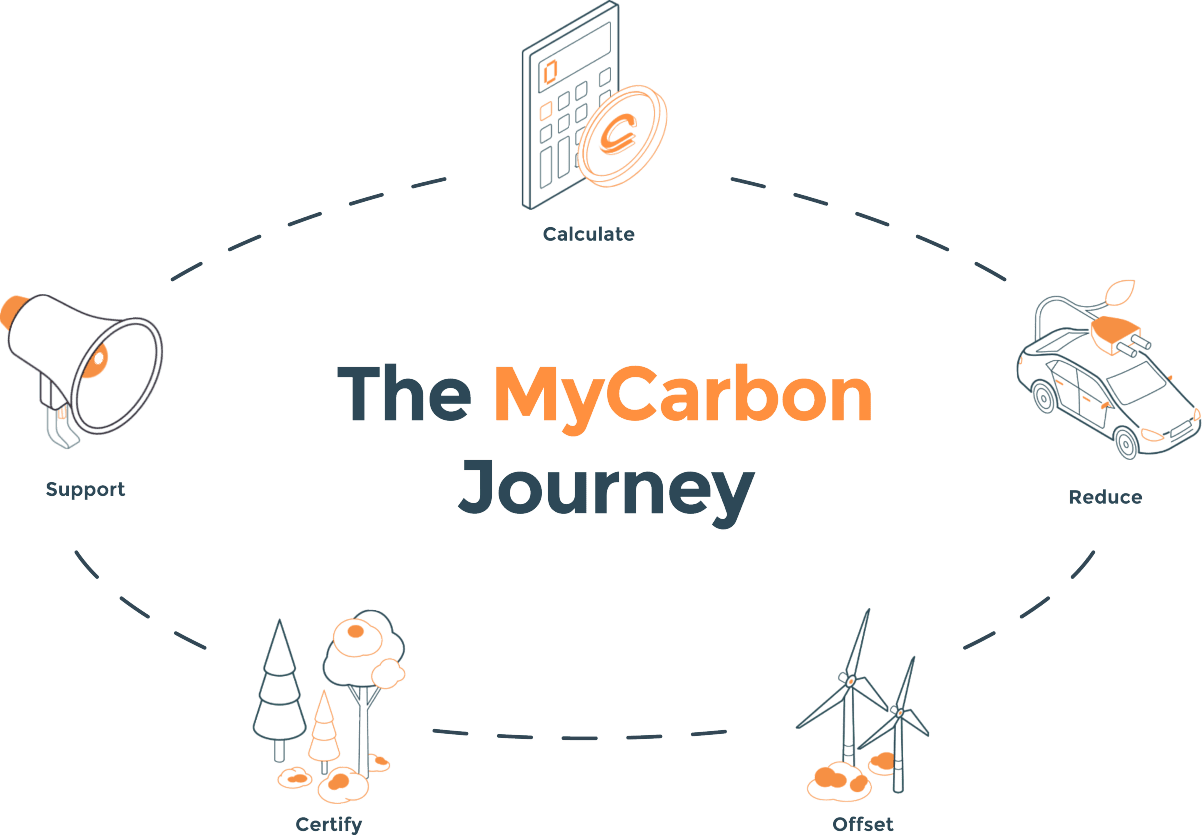

The MyCarbon Journey

Welcome to your roadmap to becoming a climate champion. It might seem daunting to navigate the complexities of carbon reduction, but that's where we step in!

Find out where you should start by taking our short quiz to pinpoint exactly where you are now. From there, we'll guide you on reducing your environmental footprint, bolstering your competitive edge, and building a resilient, future-focused operation. Click below to get going!

Welcome to your roadmap to becoming a climate champion. It might seem daunting to navigate the complexities of carbon reduction, but that's where we step in!

Find out where you should start by taking our short quiz to pinpoint exactly where you are now. From there, we'll guide you on reducing your environmental footprint, bolstering your competitive edge, and building a resilient, future-focused operation.

Click the button to get going!

Why MyCarbon?

We are MyCarbon, an industry leading provider of carbon management solutions for businesses.

From humble beginnings as a side passion during a PhD course, today we are one of the best at calculating, reducing, and offsetting carbon footprints, empowering businesses of all sizes to achieve net-zero.

We're not ‘clock in and out’ consultants - we're playfully pragmatic partners, blending flexibility, academic training, and in-depth knowledge to tailor our services to your unique needs.

Our approach draws on the scientific and engineering expertise of our team so that we can always create a bespoke and actionable plan for you and your goals.

Our mission is that for every hour MyCarbon and our clients spend working together, we produce the largest positive environmental impact possible. Let’s start that clock...

Proud sustainability delivery partner for:

CALCULATE

MyCarbon’s team of experts provide transparent insights into your company’s emissions.

REDUCE

Our reduction strategies help you cut your emissions and streamline your daily operations.

OFFSET

MyCarbon’s experts offer a clear and certified way for businesses to offset their carbon footprint.

CERTIFY

Become the climate champion you want to be, with confidence and credibility.

SUPPORT

Delivering an effective sustainability strategy is increasingly part of running a successful, future focused business.

Leverage our experience, processes, templates and guidance to ensure that your actions are the right steps to take and drive the biggest positive impact possible across your business.

Get started on your journey to becoming a climate champion and book a call with the MyCarbon team today:

(We're real friendly and would love to meet you)

Are you asking these questions?

We get it. Sustainability can be daunting. And it can be easier to see barriers, rather than opportunities.

But we've helped clients across all industries master their carbon management and become climate champions. Below are some of the initial questions they asked when exploring the carbon journey ahead.

The MyCarbon team have also answered lots of questions on the process and a wide range of sustainability subjects, in our FAQ page.

"I don't need to manage my carbon impact yet."

Knowing your carbon footprint can reveal sustainable savings in your business...

"I know it's good for the planet, but what's in it for me?"

We've got seven great reasons you should care about planet AND profit...

"It's going to be too expensive to start."

We believe our competitors are overcharging you for very simple services...

"I don't have the time to do this on top of running my business."

You certainly don’t, which is why we’re here...

"What actually happens in this process?"

The unknown is off putting and stops many businesses from getting started in managing their impact...

"How can I trust the results I get?"

Our expert consultants have hands-on experience in a range of industries and are trained to deliver top-notch work based on internationally recognized standards...

Here's what our clients are saying...

MyCarbon's Client Community

Our clients are making a huge impact already. Time to join them?

In 2020, BrewDog became the world’s first carbon negative brewery. During this time, we supported BrewDog on the MEGA 3.0 report, showcasing their roadmap for zero operational emissions by 2023.

The Hut Group (THG) selected MyCarbon for their comprehensive and practical approach to sustainability. Through their collaboration, MyCarbon developed a clear roadmap for THG’s long-term sustainability goals.

MyCarbon's work supported Look Fantastic's in moving to a more minimalist packaging approach, cutting down on over £2 million in costs across their packaging and supply chain whilst still providing great customer experience and value.